The new initiative is part of Unity’s broader push to reinvent live events with game engine technologies.

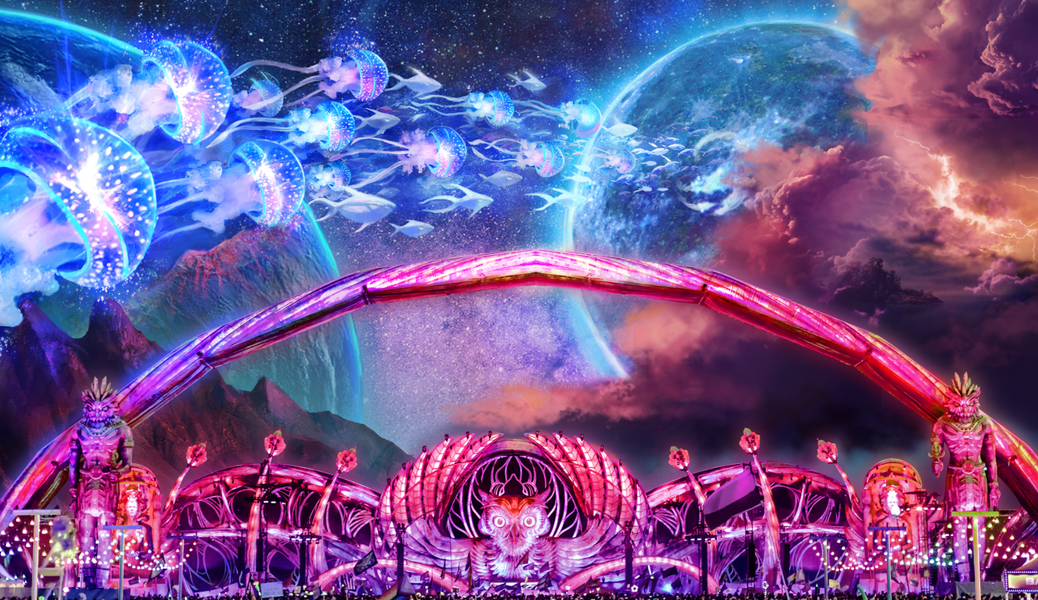

Unity and Insomniac want to build an EDM metaverse.

The beat don’t stop in the metaverse: Unity Technologies has struck a deal with Insomniac Entertainment, the EDM arm of Live Nation, to build a persistent metaverse world for electronic music fans. The partnership, which is officially being unveiled at SXSW this weekend, is part of Unity’s push to use game engine technologies for live events across sports and music.

Unity’s SVP and GM of live sports and entertainment, Peter Moore, told Protocol that the goal was to expand the potential audience of Insomniac events to “tens, if not hundreds of millions of people” from around the world who otherwise wouldn’t have a chance to attend festivals like EDC.

Moore didn’t reveal many details about the project, but he said that the goal was a lean-forward experience on a standalone platform. Referring to popular EDM artists like Skrillex and DJ Tiesto, he said: “They’ve got millions of fans themselves. I don’t think they want to be subsumed into the Meta-metaverse. I think they want to create their own world.”

Unity previously announced a partnership with the UFC to enhance sports broadcasts with real-time technologies. Asked what other areas of live entertainment the company was looking to get into, Moore said that Unity would stick with sports and music for the time being.

However, he also suggested that the same technology could theoretically be used to enhance Broadway shows and give audience members from around the world a chance to virtually be on stage during a “Hamilton” performance. “The technology applies itself to all forms of live entertainment,” Moore said.

Janko Roettgers (@jank0) is a senior reporter at Protocol, reporting on the shifting power dynamics between tech, media, and entertainment, including the impact of new technologies. Previously, Janko was Variety’s first-ever technology writer in San Francisco, where he covered big tech and emerging technologies. He has reported for Gigaom, Frankfurter Rundschau, Berliner Zeitung, and ORF, among others. He has written three books on consumer cord-cutting and online music and co-edited an anthology on internet subcultures. He lives with his family in Oakland.

Mobile game revenue will decline for the first time in history this year, market research firm Newzoo now says in a revised outlook for the 2022 global games market. While the whole game industry is expected to contract by 4.3% — another first since Newzoo began tracking the market in 2007 — the company is predicting a 6.4% decline in mobile game spending on top of a 4.2% decline in console game spending.

Back In May, Newzoo was forecasting a year of growth for the game industry, with its outlook predicting more than $200 billion in global games industry spending thanks to a nearly 6% increase in the mobile gaming sector to a $103.5 billion. But this summer, as warning signs emerged about the effects of inflation and a severe downturn in the digital ads market, analysts and market researchers began to predict a unprecedented decline for the game industry, which in 2020 and 2021 grew at staggering rates due to excess spending on and time spent playing video games. In particular, mobile gaming declined in the first half of the year for the first time ever.

Mobile gaming has typically offset the losses in console and PC gaming and has been the largest and fastest-growing sector in the industry for years. But this year’s decline marks a surprising downturn for mobile. “Mobile game spend in the U.S. continues to decline as consumers contend with both economic uncertainties and a new post-pandemic normal,” said Sensor Tower gaming insights lead Dennis Yeh last week. “While there is still a decent chance this year’s U.S. mobile game revenue will surpass 2021 levels, worsening headwinds have firmly shifted the conversation away from the question of by how much.”

A confluence of factors has created a particularly difficult time for game developers, and not just mobile ones. For one, consumers are spending less on gaming due to inflation increasing the price of everyday goods. A number of high-profile console and PC games have also suffered from delays this year, setting up a return to growth in 2023.

“Some of the drivers of the decline include the return of experiential spending, higher prices in everyday spending categories such as food and fuel, the uncertain supply of video game console hardware and certain accessories such as gamepads, and a lighter release slate of games, among others,” explained NPD game director Mat Piscatella back in July, when NPD forecast a 8.7% decline in the U.S. game market.

Additionally, the digital advertising market on which many mobile games rely for revenue is also having a tough year, in part because Apple’s iOS privacy changes have made it more difficult to track the effectiveness of the install ads through which many mobile developers both acquire new users and also earn money from other app makers. (Many mobile games allow players to earn digital currency by watching ads prompting them to install competing games.)

Advertisers are also simply spending less. “The timing here is clear: The declines take place as the world’s banks increased interest rates and the specter of recession was everywhere in the press,” Unity CEO John Riccitiello said on an earnings call this month. “When we talk with our advertisers, the sense we get is clearly one of caution and reticence to commit to the aggressive campaign spends.” Unity, the game engine of choice for mobile developers, also runs a digital ads business. Some major publishers like Zynga owner Take-Two Interactive have also cited mobile when downgrading annual outlooks in recent weeks.

Newzoo in a press release said, “2022 is a corrective year following two years of lockdown-fueled growth, but our long-term outlook for the games market remains positive,” and the firm says it still expects gaming to hit surpass $211 billion in global spending by 2025.

“While this may seem like a setback for the games market, we note that the sum of revenues generated from 2020 to 2022 is almost $43 billion higher than we originally forecast pre-pandemic,” the company said.

Amazon is planning to lay off thousands of employees, Protocol has learned, ahead of what the company has cautioned will be a slow holiday shopping season.

As many as 10,000 workers could be impacted, according to a source familiar with the deliberations. That number could ultimately change. The layoffs could largely affect new hires, including those who have not yet started but who have signed an employment contract, they added. Among those impacted will be employees in the devices, human resources, and retail divisions, according to The New York Times, which first reported the layoffs.

An Amazon spokesperson declined to comment.

Amazon has been in cost-cutting mode for a while. Among other measures, it currently has a hiring freeze in place, according to a note from HR leader Beth Galetti that Amazon published publicly earlier this month.

Google agreed to pay $391.5 million and make changes to its user privacy controls as part of a settlement with a coalition of 40 state attorneys general. The coalition accused Google of misleading customers about location-tracking practices that informed ad targeting.

The deal represents the largest privacy settlement won by states in U.S. history. Even so, the payout amounts to a drop in the bucket for Google’s parent company Alphabet, which reported $13.9 billion in profit from the last quarter alone. In January, a smaller coalition of AGs sued Google over the location-tracking issue. And last month, Arizona attorney general Mark Brnovich won an $85 million settlement from Google over it.

State AGs had been working on this case since 2018, following an Associated Press report that found Google tracked users’ location data even when they explicitly turned off “Location History” tracking in Android or iOS settings. At the time, Google denied wrongdoing and maintained that users could further limit location-tracking services by turning off “Web and App Activity.” The AGs weren’t convinced, likely in part because Google’s in-house copy at the time told customers that “with Location History off, the places you go are no longer stored.”

A Google spokesperson told Protocol that the settlement was consistent with improvements made in recent years, and that the case involved “outdated product policies that we changed years ago.” As part of the settlement, Google will further clarify location-tracking disclosures beginning next year, The New York Times reports.

“The transparency requirements of this settlement will ensure that Google not only makes users aware of how their location data is being used, but also how to change their account settings if they wish to disable location-related account settings, delete the data collected and set data retention limits,” Michigan attorney general Dana Nessel wrote in a press release.

State AGs have had to compensate for a lack of online privacy regulation at the federal level. That may soon be changing, however, as Politico reported on Monday that a bipartisan group of lawmakers intends to push the American Data Privacy and Protection Act through in the lame duck session.

ADPPA includes provisions protecting user geolocation data, including its transfer to third parties. The bill leaves enforcement up to the FTC, state AGs, state privacy authorities, and the California Privacy Protection Agency.

FTX has filed for bankruptcy and the crypto company also announced that founder Sam Bankman-Fried has resigned as CEO.

FTX, Bankman-Fried’s trading firm Alameda Research, and roughly 130 affiliated companies have begun bankruptcy proceedings “to begin an orderly process to review and monetize assets for the benefit of all global stakeholders,” the company announced on Twitter Friday.

The filing includes FTX.US, a separate operation Bankman-Fried had previously claimed was isolated from the parent group’s woes. FTX.US had recently warned customers that it would have to stop trading in the coming days.

John J. Ray III, a lawyer who helped run Enron post-bankruptcy, has been named CEO of the FTX Group. Bankman-Fried, often known as SBF, will remain “to assist in an orderly transition,” the company said.

FTX’s fall was a sudden, jarring collapse of a crypto powerhouse, evident in Ray’s initial statement as CEO. He appealed to stakeholders to “understand that events have been fast-moving and the new team is engaged only recently.”

“I want to assure every employee, customer, creditor, contract party, stockholder, investor, governmental authority and other stakeholder[s] that we are going to conduct this effort with diligence, thoroughness and transparency,” Ray said in a statement.

The announcement capped a wild week for FTX and the entire crypto industry.

FTX had been one of crypto’s largest exchanges. But disclosures about its questionable finances triggered a meltdown. Binance announced early this week that it had agreed to buy the company but then announced that FTX had financial issues that were “beyond our control or ability to help.”

Even before its filing, FTX’s woes were having spill-on effects on other companies. BlockFi, a crypto lender FTX had agreed to backstop earlier this year with a credit line and an option to buy the company, said Thursday it could not conduct “business as usual” and had stopped customer withdrawals.

The broader crypto market, which was already reeling from a dramatic crash that wiped out $2 trillion in value, took another hit as the market value of issued tokens fell below $900 million. The price of bitcoin dipped below $17,000.

Salesforce recently updated its internal policies to make it easier for managers to terminate employees for performance issues without HR involvement, Protocol has learned, a move that comes as the software giant looks to shed as many as 2,500 jobs.

Previously, Salesforce’s employee relations team was heavily involved behind the scenes in the process of putting employees on performance improvement plans or terminating them for failing to hit certain metrics, including prior to any formal discussions with workers.

Now, managers will be able to put employees on performance improvement plans, or PIPs, and ultimately terminate them with little HR oversight, according to sources with knowledge of the deliberations. Managers were recently asked to sign a document indicating that, under this new system, they would treat employees fairly, one source added.

A Salesforce spokesperson and Chief People Officer Brent Hyder did not respond to request for comment.

Salesforce’s HR team was scrambling last week to update the company’s policies ahead of Monday’s layoffs, according to sources and internal documents reviewed by Protocol. As part of the so-called “Performance Improvement Framework” revisions, internal resources including “Termination Talking Points” and the “Global PIP Template” were changed to reflect the greater authority given to managers and provide additional resources to help leaders act with a degree of autonomy.

By empowering managers, Salesforce can more easily shed its ranks as it looks to trim potentially thousands of jobs. Such a system is not unheard of in the industry, but it could open Salesforce up to legal challenges if, for example, someone in a protected class believes they are wrongly terminated.

Salesforce is taking cost-cutting measures seriously. Salespeople who were laid off on Monday were given two months’ severance, according to both a current and former employee, a much less lucrative package than the company previously provided. It’s also noticeably less generous than others. Meta, for example, offered 16 weeks of pay to the 11,000 employees it laid off this week.

And while Meta based a portion of the severance on tenure, Salesforce employees who had been at the company for over a decade received the same package as those who had been there for much less time, the sources said.

The Consumer Financial Protection Bureau said fraud and scam reports comprise the top complaint it receives about virtual currencies — and that customers are finding little help from companies when it happens.

In an analysis published Thursday, coming as FTX’s potential collapse has roiled the entire industry, the CFPB detailed how reports of fraud make up about 40% of the more than 8,300 cryptocurrency-related complaints it received between October 2018 and September 2022.

“Our analysis of consumer complaints suggests that bad actors are leveraging crypto-assets to perpetrate fraud on the public,” CFPB director Rohit Chopra said in a statement. “Americans are also reporting transaction problems, frozen accounts, and lost savings when it comes to crypto-assets. People should be wary of anyone seeking upfront payment in crypto-assets, since this may be a scam.”

The analysis found “that complaints related to crypto-assets may increase when the price of bitcoin and other crypto-

assets increase,” as noted in the report. With prices falling rapidly this year, fraud and scam reports have captured a greater share of overall complaints.

“This issue appears to be getting worse, as fraud and scams make up more than half of virtual currency’ complaints received thus far in 2022,” the report said. “Some consumers stated that they have lost hundreds of thousands of dollars due to unauthorized account access. The prevalence of fraud and scam complaints raises the question of whether crypto-asset platforms are effectively identifying and stopping fraudulent transactions.”

A common scam, the report found, is called “pig butchering.” As described in the report, “fraudsters spend time gaining the victim’s confidence, trust, and romantic affection in order to get victims to set up crypto-asset accounts, only for the scammers to ultimately steal all their crypto-assets.”

The FBI has also warned consumers about pig-butchering scams.

Consumers also reported “SIM-swap” attacks among methods hackers are using to exploit two-factor authentication and gain access to accounts. “Companies often responded to these complaints by stating that consumers are responsible for the security of their accounts,” the report said.

Fraud and scam reports represented about 63% of the crypto-related complaints received by the CFPB in September, the most recent month analyzed by the agency. The second most common complaint, “other transaction problems,” marked 15% of complaints.

The report comes near the end of a tumultuous week, even by the standards of the rollercoaster crypto industry. FTX’s unraveling and Binance’s decision to back away from a deal to acquire it has had ripple effects across the sector. The largest cryptocurrency, bitcoin, has fallen 16% over the past five days.

While the SEC and CFTC have been seeking to exercise oversight of crypto exchanges, the CFPB supervises electronic fund transfers and has broad powers to take action against financial practices it views as unfair, deceptive, or abusive. When the agency receives a complaint, it is typically sent to the company for a response and can be forwarded to other regulatory agencies for further investigation.

The full CFPB crypto analysis is available on its website.

Correction: An earlier version of this story misstated the second most common complaint to the CFPB. This story was updated on Nov. 10, 2022.

Elon Musk sent his first email to Twitter staff late Wednesday, warning of a difficult economic road ahead and telling employees they need to be in office for a minimum of 40 hours per week. “Sorry that this is my first email to the whole company, but there is no way to sugarcoat the message,” he began, ominously.

Musk continued by emphasizing that relying on advertising revenue makes Twitter vulnerable, which is why he’s pushing the new Twitter Blue Verified subscription so hard. The subscription costs $8 a month and is already causing problems with impersonation. “Without significant subscription revenue, there is a good chance Twitter will not survive the economic transition,” the email, seen by Protocol, reads. Musk doesn’t completely throw advertising under the bus, however, linking to a recording of his Twitter Spaces on the topic.

Remote work is no longer allowed at Twitter starting Thursday. By the time the email was sent, it was already midday for Twitter employees in Japan and 30 minutes before work hours for employees in Dublin. Musk said he will personally review requests for employees wishing to continue remote work. He hedged the Thursday start date slightly, writing: “Obviously if you are physically unable to travel to an office or have a critical personal obligation, then your absence is understandable.”

Twitter was one of the tech companies leading the charge with “remote work forever” when the pandemic started, and the change is predictably prompting pushback from employees. After Musk’s email went out, a senior legal counsel at Twitter told employees in the company’s New York City office Slack channel they believed no one has an obligation to return to office — especially not on short notice — as the mandate represents a fundamental change to their employment contracts, according to screenshots reviewed by Protocol.The counsel also encouraged Tweeps to use Twitter’s unlimited PTO policy to take the day off.

The counsel also noted that Twitter’s CISO, chief privacy officer, and chief compliance officer also all resigned from the company late Wednesday. Former CISO Lea Kissner confirmed their departure from the company in a Thursday tweet.

Many tech workers have grown accustomed to remote work. The change in policy may push more Tweeps to leave — but this may be Musk’s intention. After a week of owning Twitter, Musk laid off half the company via an unsigned email. He later tried to get some of those employees back.

Binance isn’t buying FTX after all. The crypto giant said Wednesday it has decided that it “will not pursue the potential acquisition” based on a “corporate due diligence” review.

The company cited recent reports that FTX allegedly “mishandled customer funds” and that the company is under investigation by U.S. regulators.

Binance said it had hoped “to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help.”

The reversal caps a tumultuous week in crypto which began with reports raising questions about FTX’s finances. That triggered Binance’s decision to liquidate its holdings in FTX’s native FTT token, which led first to a war of words between Binance CEO Changpeng “CZ” Zhao and FTX’s Sam Bankman-Fried; to a further selloff in FTT and a move by FTX to stop customer fund withdrawals; and finally an announcement Tuesday that the two crypto powerhouses had tentatively agreed to merge.

Zhao had said his company had signed a “nonbinding” agreement, noting that they had the “the discretion to pull out from the deal at any time.”

Far from reassuring the market, the uncertainty surrounding FTX’s future triggered a broader crypto market selloff. Bitcoin fell below $16,000, erasing recent gains since the start of crypto winter.

“Every time a major player in an industry fails, retail consumers will suffer,” Binance also said. “We have seen over the last several years that the crypto ecosystem is becoming more resilient and we believe in time that outliers that misuse user funds will be weeded out by the free market.”

FTX could not immediately be reached for comment.

On Wednesday, John Kerry unveiled a plan for a new carbon credit program aimed at mobilizing private capital to help middle-income countries transition away from coal and move toward renewable energy.

The plan, dubbed the Energy Transition Accelerator, was announced in partnership with the Bezos Earth Fund and the Rockefeller Foundation. Kerry, who is the Biden administration’s climate envoy, told an audience at the COP27 climate conference in Egypt that the goal is to “have this up and running no later than COP28,” which will take place next year in Dubai.

The accelerator would allow companies to buy carbon credits, which would fund renewable energy projects in developing countries. Those companies would then be able to count the emissions cuts toward the reaching of their own net zero goals.

Carbon credit programs like this have been criticized historically for a multitude of reasons, ranging from being used to greenwash corporations to being an ineffective way of achieving emissions reductions. Some organizations that were briefed on the plan prior to the announcement, including the Natural Resources Defense Council and the World Resources Institute, weren’t supportive of the plan because they felt it could undermine global net zero goals, according to The New York Times.

“We’ve seen offsets being used as greenwashing and to delay action,” Harjeet Singh, head of strategy for the Climate Action Network, told E&E News. “I think the big question is, how is this going to be different?”

Those concerns echo a United Nations report published on Tuesday that found that for companies to meet their net zero goals, they “must use credits associated with a credibly governed standard-setting body that has the highest environmental integrity with attention to positive social and economic outcomes where the projects or jurisdictional programs are located.” For companies to responsibly use carbon credits, they should ideally only help to cover the last 5% to 10% of emissions.

Kerry announced a few safeguards to try to quell skepticism, including that fossil fuel companies would not be allowed to participate in the program. Only companies with net zero goals and science-based interim targets will be allowed to participate, and they must use the credits to “supplement, not substitute” emission reductions. He also said that a portion of finance must go toward “supporting adaptation and resilience in vulnerable countries where it’s difficult to attract capital to these two sectors.”

“The fact is that we have to accelerate the clean energy transition, and, my friends, it takes money to do that,” he said, noting that the bulk of that investment needs to go toward emerging and developing economies. An International Energy Agency report put out last year found that to reach net zero by midcentury, the world will need to ramp clean energy spending up to more than $4 trillion annually by 2030.

“No government in the world has enough money to get this job done,” Kerry said. (Developed countries, for their part, have failed to provide promised climate aid to emerging economies. This isn’t the first time the U.S. has tried to tap private money to make up the difference.)

Chile and Nigeria have expressed “early interest” in taking part in the program, as well as Microsoft and Pepsi, according to a press release from the State Department.

The agency will work alongside the Bezos Earth Fund and the Rockefeller Foundation over the next year to develop additional rules and safeguards for participating companies, as well as develop a methodology for monitoring, reporting, and verifying that the carbon credits are real, additional, and permanent.

“The beauty of voluntary carbon markets, if it is done right … has the virtue of bringing in money that doesn’t need to be repaid,” Andrew Steer, president and CEO of the Bezos Earth Fund, said at the press conference.

Michelle Patron, Microsoft’s director of sustainability policy, also spoke at the press conference, adding that a big focus of the company’s energy procurement strategy includes enabling a just transition in the Global South. (In an interview with Protocol in the run-up to COP27, Microsoft president and vice chair Brad Smith also said working with the Global South was a high priority for the company.)

“We’ve seen clean energy investments in the developing world be flat since Paris, so we need investments to go up, and we need the costs to come down. And the enablers that we see at Microsoft to do that are markets, policy, and skills, and that’s why this type of initiative is important,” Patron said.

Meta announced it was laying off more than 11,000 employees Wednesday morning, slashing jobs in its recruiting department and refocusing its remaining team on AI discovery, ads, and its investment in the metaverse.

“I want to take accountability for these decisions and for how we got here,” Mark Zuckerberg wrote in a message to employees that was also posted online. “I know this is tough for everyone, and I’m especially sorry to those impacted.”

The layoffs, which The Wall Street Journal had earlier reported were coming, affect some 13% of Meta’s workforce as the company scrambles to recover from the catastrophic collapse of its stock price. Zuckerberg said the company is also shrinking its real estate footprint in order to contain costs, and extending its current hiring freeze through the first quarter of 2023.

Zuckerberg attributed the layoffs to the company’s enormous growth at the start of the pandemic. “Many people predicted this would be a permanent acceleration that would continue even after the pandemic ended,” Zuckerberg wrote. “I did too, so I made the decision to significantly increase our investments. Unfortunately, this did not play out the way I expected.”

The Meta layoffs come less than a week after Elon Musk cut a large portion of Twitter’s employees overnight. But in stark contrast to Twitter’s layoffs, during which employees found themselves suddenly locked out of work devices without any explanation that they’d been laid off, Zuckerberg detailed a number of the benefits laid-off Meta employees will have going forward, including 16 weeks of severance, six months of health insurance coverage, three months of career services, and immigration support. Employees will also receive their RSU vesting next week and be paid for uncompleted time off.

Zuckerberg acknowledged “this is a sad moment” in the company’s history, but tried to sound an optimistic note about Meta’s future. “I believe we are deeply underestimated as a company today. Billions of people use our services to connect, and our communities keep growing,” he wrote. “I’m confident that if we work efficiently, we’ll come out of this downturn stronger and more resilient than ever.”

Al Gore has one mission this week at COP27, and that’s to give climate negotiators what he hopes will be a critical tool to address the crisis at hand: an independent, global inventory of greenhouse gas emissions, down to the individual facility.

The Climate TRACE coalition just released the world’s most detailed inventory of global greenhouse gas emissions, which Gore, a founding member, is unveiling on Wednesday at the United Nations climate summit in Egypt.

“Of course, the world has long known what the overall amount of greenhouse gas pollution in the atmosphere is. What’s different about this [database] is the accurate apportioning of who’s responsible for what and the granularity that allows us a focus on specific emissions sources,” Gore told Protocol, adding that he has “no doubt” that the database “will be put to a lot of use in negotiations for sure.”

The inventory shows facility-level emissions, which will allow negotiators to home in on the most polluting sites in individual countries, helping them target where emissions reductions should come from. Putting a solar farm in one place might displace significantly more emissions than locating it somewhere else, and the inventory allows negotiators to identify exactly where they would get “the biggest bang for their buck.”

The inventory, published on Wednesday on Climate TRACE’s website and free for anyone to access, includes emissions data for 72,612 individual sources, including power plants, steel mills, and oil and gas fields. It also includes sources that can move between countries, such as cargo ships.

That granularity will be critical for countries to have an accurate accounting of their emissions and where they come from, particularly countries that don’t have the resources to gather that data themselves. It will also help corporations looking for the most cost-effective, impactful way to cut emissions, said Gavin McCormick, another founding member of the coalition.

“One of the exciting parts for us has been to move the conversation from countries arguing in some vague sense about accountability to, ‘Hey, we’re talking about these few facilities here,” McCormick said.

Using AI and satellite data, Climate TRACE was able to determine that a significant share of carbon pollution comes from a small number of facilities. The database shows that one steel mill in Korea, for example, emits more greenhouse gas pollution in a year than all of Bosnia. “The politics of how you would transition a few facilities is strikingly different than when you’re saying, ‘Who could know where it’s coming from?’” McCormick said.

Many countries lack accurate, granular, and up-to-date emissions data. That’s in part due to resource constraints, particularly in smaller or poorer countries. Egypt, for example, released a partial inventory of its 2015 emissions for the first time this year. Some of the data is self-reported by polluters, collected via surveys of key facilities and then extrapolated to create a country-level estimate. In India, “I know they’re literally out there counting cows for a few farms and then assuming these farms are representative for the whole country,” McCormick said.

Climate TRACE’s data show emissions at the facility-level.Image: Climate TRACE

Climate TRACE’s data show emissions at the facility-level.Image: Climate TRACE

One key insight that came out of this inventory was that oil and gas emissions are “massively undercounted” in official estimates, he said. Through satellite data, the coalition found that oil and gas leaks were a significant source of “super-emitting” sites.

When asked if he thinks the undercounting of emissions from the oil and gas sector was deliberate or not, Gore said, “There are several specific examples that are hard to interpret in any way other than the fact that there has been an intentional effort to hide emissions and to deceive the world community about how large the emissions are. It’s just almost impossible to believe that it’s an accidental oversight, and all the accidents go in exactly the same direction.”

Gore, however, is not interested in Climate TRACE being the “climate cops.” He views the coalition as more of a “neighborhood watch,” which is often contacted by law enforcement for local information. “I will not be at all surprised if some — maybe many — governments use the information to make sure that their laws and regulations are complied with,” he said.

It’s not just governments who can benefit from the inventory release, but private companies as well.

The cleanest steel mills aren’t being used at full capacity. Yet shifting business to these mills could reduce emissions from the steel sector by 50%, McCormick said.

Companies that want to decarbonize their supply chains — which includes a number of major tech companies from Salesforce to Apple — can simply use the information to purchase products from the cleanest facilities. The coalition has already started having conversations with multinational corporations about switching suppliers, which can happen in a matter of months rather than years, if they’re armed with independent data.

By next year, Climate TRACE hopes to update the inventory to include every source of emissions and, eventually, get it closer to updating in real time. Right now, the data as a whole is at least annual up until 2021, with some sectors updated monthly.

“My belief is that if we can demonstrate to the world that it’s actually easier than they thought to make progress and we can actually track that progress, this is going to be the year that a lot of countries start tasting some serious progress,” McCormick said.

Way back in March, your friendly Protocol Climate team offered you some tips for writing a climate plan that doesn’t suck. Surely you took that advice. But if for some reason you didn’t, the United Nations has your back.

The U.N. dropped a 10-step how-to guide to ensure net zero plans are real talk and not greenwashing, care of an expert panel that has a name much too long to print. And it’s well worth a read whether you’re a CSO looking to improve your company’s climate plan or a Big Tech watchdog who wants to make sure companies are doing the right thing.

Among the 10 recommendations, a few jump out. No shade to recommendation one (publicly announce a net zero plan), but some of the others are salient and a little less remedial, particularly for tech companies:

Big Tech is already doing some things right. The industry is better at setting climate goals than other sectors of the Fortune 500.

Binance CEO Changpeng “CZ” Zhao said Tuesday the crypto powerhouse signed a deal to acquire rival FTX.

CZ said in a tweet that FTX “asked for our help,” adding that due to “a significant liquidity crunch,” Binance had signed a nonbinding letter of intent to acquire FTX “to protect users.”

FTX CEO Sam Bankman-Fried also said in a tweet that the company had “come to an agreement on a strategic transaction with Binance for FTX,” adding, “Things have come full circle.” Binance was an early strategic investor in FTX, but FTX bought out its stake last year, with Bankman-Fried suggesting the companies differed on regulatory issues.

The announcement follows a Twitter tit-for-tat between the two crypto giants over questions related to the finances of Alameda Research, the trading house started by Bankman-Fried. CZ announced that Binance was liquidating its holdings of FTX’s native FTT token, describing the move as “post-exit risk management, learning from” luna, a token Binance had backed that imploded earlier this year.

CZ also suggested a deeper rift between the two companies, adding, “We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t support people who lobby against other industry players behind their backs.”

Binance is crypto’s biggest exchange with a daily trading volume of roughly $31 billion, according to CoinMarketCap. FTX is third with about $3.5 billion daily trading volume.

FTX had appeared to halt withdrawals Tuesday before the announcement, according to on-chain analytics cited by some observers on Twitter. Bankman-Fried said the deal would allow withdrawals to resume.

Salesforce is preparing for a major round of layoffs that could affect as many as 2,500 workers across the software vendor, Protocol has learned, in a bid to cut costs amid a new activist investor challenge and harsh economic conditions.

The company plans to lay off a large number of individuals, roughly 2,000 people or more, for “performance” issues, according to both an industry source and a former employee. Several hundred more, likely those workers who fall under a protected group like individuals with disabilities, will be placed on a 30-day review, with the intention of letting them go once that concludes, according to one source. It was unclear when the layoffs would begin, the sources added, as discussions on the plan remain ongoing. However, they are likely to happen before the Thanksgiving holiday.

Salesforce spokesperson Carolyn Guss did not respond to repeated requests for comments. Chief people officer Brent Hyder and chief equality officer Lori Castillo Martinez also did not respond to request for comment. However, in statements provided to other news outlets following publication, Salesforce confirmed it eliminated hundreds of jobs on Monday.

When Salesforce underwent layoffs in August 2020, it provided 60 days’ notice and severance, including placement services and a few months of benefits to affected employees. If the company is taking the stance that workers are being let go for under-performance, it’s unclear if it would extend the same type of package.

Investors are increasingly demanding a greater return from Salesforce, which has always funneled its profits toward growth, including spending billions to acquire companies like Slack and Tableau. The company is also now facing pressure from activist investor Starboard, which recently disclosed a “significant” but still unknown stake in Salesforce.

Salesforce previously laid off roughly 90 contract workers and implemented a hiring freeze through January 2023. At the time, a spokesperson said that “limited hiring continues” but that “most departments have reached their hiring goals for the fiscal year.”

BlockFi has introduced a new digital assets interest product for accredited investors, after previously agreeing to shut down a yield-paying crypto product that the SEC said was illegal.

Crypto lending has come under scrutiny by the SEC and state regulators, many of whom have said that crypto lending products are securities, some with substantial risk, and should be regulated as such.

In February BlockFi agreed to pay a $100 million penalty to the SEC for offering and selling its BlockFi Interest Accounts product.

The new product is initially open to U.S. accredited investors only. It will be open to some customers by the end of the year and all U.S. customers at the start of 2023.

The product will have “competitive interest rates” on 15 digital assets including bitcoin and ether and no minimum investment.

Earlier this year, BlockFi faced a rapid downturn in the crypto markets and laid off 20% of its staff. It also entered into an agreement with FTX in which the crypto exchange provided BlockFi with a $400 million credit line and in return gained an option to buy BlockFi.

The purchase price was reportedly dependent on certain performance milestones, including the SEC approval of this new interest product, which would boost the purchase price by $25 million.

The Justice Department said Monday it seized $3.4 billion worth of bitcoin stolen in the 2012 hack of the Silk Road dark web marketplace.

The DOJ said it recovered more than 50,676 bitcoin from the home of James Zhong who pleaded guilty to wire fraud charges following what the agency described as the largest cryptocurrency seizure in its history.

The DOJ recovered the stolen bitcoin in a November 2021 search of Zhong’s home in Gainesville, Georgia. The department said agents found the keys to the tokens in an underground floor safe and on a “single-board computer that was submerged under blankets in a popcorn tin stored in a bathroom closet.”

Zhong “executed a sophisticated scheme designed to steal bitcoin from the notorious Silk Road Marketplace” and “attempted to hide his spoils through a series of complex transactions,” Tyler Hatcher, a special agent with the IRS criminal investigation team, said in a statement.

Silk Road was a notorious online marketplace used by drug cartels and other criminal organizations that used cryptocurrencies, mainly bitcoin, for illicit transactions. The marketplace was effectively shut down by federal authorities in 2015.

The DOJ said Zhong managed to steal bitcoin from the marketplace by creating about nine fraud accounts and “triggering over 140 transactions in rapid succession in order to trick Silk Road’s withdrawal-processing system.” He then transferred the stolen bitcoin to separate addresses under his control.

The DOJ said agents recovered other items from Zhong’s home, including $661,900 in cash, 25 Casascius coins, also known as physical bitcoins with roughly 174 bitcoin in value, and four one-ounce silver-colored bars and one gold-colored coin.

U.S. election infrastructure is exceedingly secure, and voter fraud here is so rare it’s comparable to your annual chances of getting struck by lightning. Despite this, former President Donald Trump and a long list of allies in the Republican Party have spent the last two years questioning the overall integrity of the U.S. election system. Many of those allies are now candidates themselves, and their coordinated attack on the country’s status as a democracy is not a relic of 2020. Some have already started repeating these “Big Lie” charges ahead of next week’s midterms. And the social platforms that help them spread their message have prepared few measures to stop it.

In short, many of the efforts from companies — including Twitter, Meta, and YouTube — to protect 2022’s elections look a lot like the measures the platforms took in 2020.

But many lies about the security of the whole system and the reliability of the general results still don’t fall under these policies, and such content often slips through moderation nets because it’s not clear what rules apply.

Twitter could be making the problem worse, especially given Elon Musk gutting half the company’s staff in the last 24 hours.

Meta seems to have mostly recycled its 2020 playbook, despite reporting that suggested the company’s three platforms were particularly helpful in supercharging the original Big Lie — focused on Biden’s election — in the leadup to Jan. 6.

Other platforms’ approaches don’t necessarily inspire confidence, either.

Many Republicans will win election contests fairly next week. It’s quite possible there’ll be enough of them that they’ll take control in one or both chambers in Congress. There’s real risk, though, that some will seek to overturn legitimate losses — or even that a few Democrats will sense an opening for bad behavior — by fostering doubts about whether the U.S. can still pull off real elections. The social networks seem mostly to be hoping they have the tools to tackle that. It’s not clear they do.

A version of this story appeared in Protocol’s Policy newsletter. Sign up here to get it in your inbox three times a week.

The White House just laid out its climate tech priorities to reach net zero by 2050.

As part of a new initiative to accelerate research into “game-changing climate innovations,” the Biden administration highlighted five areas where research today could have a particularly transformative impact on cleaning up carbon pollution. Among them are building efficiency, the power grid, aviation, industrial processes, and fusion energy. The initiative illustrates where the federal government believes the most promising technology will spring from as the country — and the entire world for that matter — attempts to innovate its way to net zero.

A working group with members from 17 agencies is spearheading the initiative, though it will be chaired by White House climate advisers. In its initial report, the group laid out 37 categories of technology where R&D could make major inroads. These span from reducing emissions from livestock to advanced nuclear fission. The five priority areas that the group will focus its near-term attention, though.

While we have many of the technologies needed to start cutting emissions today, an International Energy Agency report found that nearly half of the emissions reductions that the world will need to get to net zero by 2050 will involve many technologies “that are currently at the demonstration or prototype phase.” The administration (as well as the tech industry) will now work to speed up getting them ready for deployment.

With that in mind, the report defined potential “game-changers” to include new technologies with no current commercial adoption (such as fusion energy), improved existing technologies (such as direct air capture), or combinations thereof. Some of those technologies that the White House highlighted have proved controversial or seen high profile failures, though. That’s not a reason to not invest in them, though, and the working group will be calibrating what the best levels of funding could look like.

“A diversified portfolio is needed to ensure success in meeting our climate commitments and capturing the opportunity for American industries to lead the global energy transition,” the group concluded in the report.

The new initiative does not come with a specific price tag or funding, though. The working group’s report said it will be “leveraging clean energy innovation investments” that were included in the bipartisan infrastructure law, the CHIPS Act, and the Inflation Reduction Act in order to accelerate research into the five near-term priority areas. The group will also lay out plans for bringing new technologies from early-stage research to widespread deployment.

Coinbase said Thursday that it lost more users in the third quarter. But the decline wasn’t the disastrous drop that Wall Street was expecting, and that sparked a rally in the crypto company’s shares after-hours.

Coinbase said its monthly transacting users fell to 8.5 million in the third quarter, down from 9 million the previous quarter and significantly lower than 11.2 million in the fourth quarter of 2021. The “Street was expecting a train wreck, and it was slightly better than feared,” Wedbush analyst Dan Ives told Protocol.

Coinbase shares were up about 4% in late trades. The company reported a loss of $2.43 a share on revenue of $590 million, compared to a profit of $1.62 a share on revenue of $1.3 billion in the year-ago quarter. Analysts were expecting a loss of roughly $2.40 a share on revenue of about $656.6 million.

Coinbase said it had “a mixed quarter” as transaction revenue was “significantly impacted by stronger macroeconomic and crypto market headwinds, as well as trading volume moving offshore,” the company said in a letter to shareholders.

But Coinbase saw “strong growth” in subscription and services revenue, aided in part by rising interest rates.

The results appear to show that Coinbase has managed to stabilize its business after a bruising second quarter and a broad market downturn. In August, the company told shareholders that the market slump “came fast and furious” and called the quarter “a test of durability for crypto companies and a complex quarter overall.”

Coinbase has been reining in costs to cope with the economic crisis, including a major round of layoffs.

The Biden administration announced $9 billion in funding Wednesday to improve home efficiency, which could help support the installation of up to 500,000 heat pumps. With winter approaching and utilities warning of gas shortages, there are some major challenges facing the technology that money can be used to tackle.

To help decarbonize home heating and cooling, we need those heat pumps, and fast. The electricity-powered systems — which keep homes comfortable by pushing heat into the home in the winter and pulling it out in the summer — will be crucial in weaning the world off of fossil fuels. But installing the units on a timeline in keeping with net zero goals will require both a robust supply chain and well-prepared labor force. While neither of these are fully in place in the U.S., the Defense Production Act and Inflation Reduction Act represent opportunities to build them out.

The funds allocated Wednesday fall under a new state- and tribe-administered rebate program made possible by the IRA. The White House said this helps put the country on track to achieve the president’s campaign promise of weatherizing 2 million homes.

To get on track for the goal of net zero by 2050, the International Energy Agency has said the global stock of heat pumps needs to reach roughly 600 million by 2030. Last year saw a 25% increase in investment in the technology and record-high growth in sales, and roughly 190 million units were in operation worldwide. However, the organization said this growth has been stymied somewhat by ongoing supply chain issues.

The U.S. currently relies largely on foreign suppliers of heat pumps, leaving the White House’s goal vulnerable to supply chain complications like those brought on by Russia’s invasion of Ukraine. Sam Calisch, head of special projects at the electrification nonprofit Rewiring America, characterizes the U.S. heat pump supply chain as “not too bad,” but he added that investment is needed as “an ounce of prevention” for future complications, especially as the market grows.

The DOE is planning to devote an initial $250 million, which isn’t part of the $9 billion, to encourage more heat pump manufacturing, funding which relies upon the DPA authorities that President Biden invoked in June to strengthen the domestic supply chain for clean energy technologies. The agency is currently soliciting opinions on how to make best use of that pot.

In a recent report, Rewiring America encouraged the DOE to invest $500 million in up to 10 facilities in the U.S. in order to “ensure that American manufacturing capacity can meet the increased demand.”

The country’s goal, Calisch said, should be that all HVAC systems are replaced by heat pumps at the end of their lives “definitely by 2030, faster if we can do it.” Rewiring America found that the U.S. installed 3.9 million heat pumps in 2021; the 500,000 unit boost provided by the IRA funds is designed to “supercharge” the market, he said, but also fits within larger market trends.

Installing all those heat pumps will also require a workforce to grow alongside the market. The IEA encourages policymakers to anticipate potential labor challenges “to avoid bottlenecks” on the way to net zero, and specifically recommends investment in knowledge-sharing and upskilling for HVAC employees.

The DOE said Wednesday it is putting together a discussion between “labor, businesses, and other key stakeholders” to determine how best to spend another $260 million, also not part of the $9 billion, on workforce development for energy efficiency. This federal investment is something Calisch said is greatly needed.

“There are new programs springing up, but we are consistently finding that, particularly around electricians, we’re facing a shortage,” Calisch said. He said one option for ameliorating that shortage is for the U.S. to reinvigorate apprenticeship programs.

The IRA contains funding that requires companies receiving wind or solar tax incentives to employ apprentices, though it doesn’t have a similar requirement for home efficiency companies. Specific companies like heat pump company BlocPower have created apprenticeship programs geared toward training a green workforce and advancing racial justice goals at the same time.

This heat pump enthusiasm is happening against the backdrop of instability in the natural gas market, prompting higher winter heating bills worldwide. The Energy Information Administration’s recent Winter Fuels Outlook anticipated a 19% increase in natural gas prices this year as compared with last. Electricity prices have also increased, but by just 8%.

“That [increase in fossil fuel prices] definitely spurs increased interest in heat pumps,” Calisch said, citing the fact that heat pumps cost users less in heating than other types of systems.

Block beat earnings expectations, with strong growth largely fueled by its Cash App business. Traders sent shares up more than 12% after-hours Thursday.

Investors are closely watching Block’s performance as a measure of broader consumer spending amid worries about inflation and a looming recession.

The payments giant generated adjusted earnings per share of 42 cents, handily beating analysts’ estimates of 23 cents, according to FactSet.

Gross profit came in at $1.57 billion, beating expectations of $1.5 billion, per FactSet, and up from $1.1 billion in the year-ago period. Analysts generally prefer to look at gross profit for Block rather than revenue since it excludes bitcoin gross trading volume. The company barely mentioned crypto in its earnings release, except to note that Cash App crypto trading revenue fell.

Total net revenue was $4.52 billion, beating estimates of $4.5 billion, and compared to $3.8 billion a year ago.

Cash App, a closely watched driver of Block’s growth, generated $774 million in gross profit, which was up 51% from the year-ago period. More than a third of monthly active users use the Cash App Card product, which generates revenue from interchange fees and other banking services.

Cash App could face more regulatory scrutiny. Though Block said it does not tolerate illegal activity, Forbes reported that Cash App appears more frequently than other services in sex ads, and law enforcement professionals are concerned about its identity checks.

Stripe is laying off 14% of its staff, its co-founders said Thursday, as the fintech startup must start “building differently for leaner times.”

The layoffs will bring the online payments company down to about 7,000 employees, according to a memo to staff from co-founders Patrick and John Collison that Stripe also posted publicly.

“We have always taken pride in being a capital efficient business and we think this attribute is important to preserve,” the email said. “To adapt ourselves appropriately for the world we’re headed into, we need to reduce our costs.”

Stripe in March 2021 raised a $600 million venture round at a $95 billion valuation, making it one of the most valuable startups in the world.

The company’s revenue and payment volume tripled from the start of the pandemic as the “world rotated overnight towards e-commerce,” the Collison brothers’ memo said. But Stripe made mistakes mistakes leading into 2022, they acknowledged.

“We were much too optimistic about the internet economy’s near-term growth in 2022 and 2023 and underestimated both the likelihood and impact of a broader slowdown,” the Collisons wrote. “We grew operating costs too quickly. Buoyed by the success we’re seeing in some of our new product areas, we allowed coordination costs to grow and operational inefficiencies to seep in.”

The job cuts will return Stripe to the head count it had in February, and the company is also cutting costs elsewhere. The firm’s recruiting division will be “disproportionately affected” by the layoffs since the company plans to hire fewer people, the Collison brothers wrote.

Affected employees will be given a minimum of 14 weeks’ severance pay, according to the memo, as well as other assistance such as immigration support for workers in the U.S. as visa holders.

Roku saw its revenue growth slow in Q3, and warned investors Wednesday that things are about to get worse: “A lot of Q4 ad campaigns are being canceled,” said Roku CEO Anthony Wood during the company’s Q4 earnings call. “We’re seeing lots of big categories pull back. Telecom, insurance … even toy marketers are planning on reducing their spending.”

As a result, Roku now expects its Q4 revenue to decline by around 7.5% year-over-year. Roku’s Q3 revenue was up 15% year-over-year, but continued pressure on hardware margins and declining margins for the company’s advertising and services business led to a net loss of $122 million. In Q3 of 2021, Roku generated close to $69 million in net income.

Roku is an interesting test case for both consumer electronics and the general video ad market. The company sells its own hardware, but generates the vast majority of its money with advertising. Both sectors typically see a major cash influx in Q4, but Roku executives warned that things will be different this time around.

“This is not a normal holiday season,” Wood said. He also insisted that marketers were pulling back across the board. “They are not spending with anyone,” Wood said. However, he expressed optimism that advertisers would move even more of their budgets to streaming once the worst of the current crisis is over. “We expect to emerge from the current advertising downturn stronger and in a better position than ever,” Wood said.

Roku recently expanded beyond streaming with the launch of its own line of smart home products, which are being manufactured by Wyze Labs. “That was a cost-efficient and expeditious way to enter that market,” Roku CFO Steve Louden told Protocol Wednesday afternoon. “We’re hoping that it does give us an opportunity to leverage [it] into a growing market over time.”

Green jobs and corporate climate pledges abound, but skilled sustainability professionals are scarce.

A new report from Microsoft and the Boston Consulting Group on “closing the sustainability skills gap” found that 57% of sustainability professionals lacked a sustainability-related degree, and that more than 40% had no more than three years of sustainability experience.

“The historical importance and current breadth of the sustainability skilling challenge are difficult to overstate,” Brad Smith, Microsoft’s vice chair and president, writes in the report. “The creation of a net-zero planet will require that sustainability science spreads into every sector of the economy.”

The job opportunities are increasing: Green jobs grew 8% per year between 2016 and 2021, according to the LinkedIn Green Jobs report. But the talent pool lagged, only growing at 6%, according to LinkedIn. Scientists are leaving academia and engineers are leaving Big Tech in order to work on climate tech, but that might not be enough to fill the widening gap.

According to the Microsoft report, more than two-thirds of sustainability leaders were internal hires. Out of a list of the 10 most commonly held jobs prior to becoming sustainability managers, four (business operation roles, program manager, quality assurance manager, and customer service representative) were unrelated to sustainability. Yet “talented insiders” without formal training are not a sustainable talent pool, the report argues.

Data and digital skills, sustainability-specific competencies such as carbon accounting and reporting, and transformational skills — including broad stakeholder management and culture and change management — were the major skill areas that sustainability pros need, the report found.

But more work is needed from employers, governments, and educational institutions to identify and fill these skills gaps, both in the current workforce and at schools: including K-12, college, vocational programs, and apprenticeships. The report outlines a three-part action plan, including initiatives Microsoft itself is undertaking.

Correction: An earlier version of this story misdated the first year that green job growth was tracked. This story was updated on Nov. 2, 2022.

Robinhood reported a drop in third-quarter revenue but also a narrower loss on Wednesday, in a sign that it might be stabilizing its business as it attempts to recover from a staggering drop in the stock and crypto trading activity that fueled its growth.

The company’s shares rose in after-hours trading. Robinhood posted a loss of 20 cents a share on revenue of $361 million, compared to a loss of $2.06 a share on revenue of $365 million in the year-ago quarter.

Financial analysts had expected a loss of 33 cents a share on revenue of $372 million, according to Zacks.

But the company said its adjusted earnings were $47 million, up $127 million from the second quarter.

Robinhood reported a 12% sequential decline in operating expenses, in an apparent sign that recent cost-cutting measures, including major layoffs, are paying off. Revenue actually rose 14% from the previous quarter.

But the company’s crypto business, an area on which Robinhood had increasingly focused, remains sluggish. Transaction-based revenue for crypto fell 12% sequentially to $51 million.

Still, CEO Vlad Tenev said the company “achieved our goal of reaching adjusted EBITDA profitability, a quarter earlier than planned.”

Robinhood has been reeling from increasingly downbeat views of its ability to become profitable more than a year after its IPO.

The economic downturn has hurt its ability to attract more users, which remains a problem. The company said its monthly active users fell 1.8 million sequentially to 12.2 million in September “as customers continued to navigate the volatile market environment.”